30 Oct 2021 0531 PM. An HSN code needs to be declared up to 31st March 2021.

The GST Council has also decided to extend the dates for the implementation of QR code and e-invoicing to October 1 2020.

. A 4-digit HSN code is to be mentioned by taxpayers with a turnover of less than Rs5 crore. Find Latest GST Rates for all Goods and Services in 0 5 12 28 slabs. List of HSN Code with Tax.

The HSN code is a 6-digit uniform code that classifies 5000 products and is accepted worldwide. Updated 4 GST tax slab rates list for different goods and services in India. Under the service tax we are paying t erections and installations code 440233 repairs and maintenance code 440245.

If a business turnover is up to 15 crore then no HSN code is required. 15 lower than last month. KIND ATTENTION OF CENTRAL EXCISE PETROLEUM SECTOR TAXPAYERS.

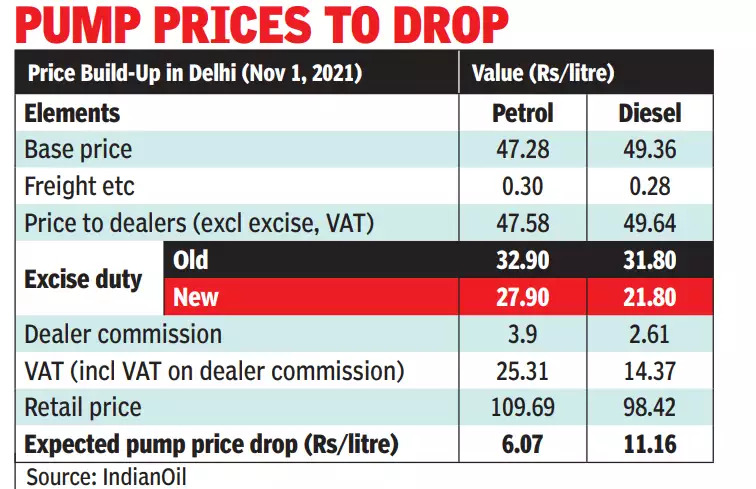

Tax2win is amongst the top 25 emerging startups of Asia and. -founder CEO of Tax2Winin. Oil companies start night shifts at depots to keep petrol.

Check Revised GST Rates list 2020-21Updated GST tax rates slab GST rates. Goods under GST Slabs. If a turnover is more than 5 crore then 6 digit HSN code will be declared.

-founder CEO of Tax2Winin. SAC Code 995415 - Construction. HSN Code GST Rate for Non-alcoholic beveragesSpirit Vinegar - Chapter 22.

HSN Code. Secondly If a business turnover is between 15-5 crore then 4 digit HSN code will be declared on the B2B invoice. Procedure relating to sanction post-audit and review of refund claims Notification issued to to waive off late fee under section 47 for the period from 01052022 till 30062022 for delay in filing FORM GSTR-4 for FY 2021-22.

GST Rate and HSN Code for mask hand wash sanitizer PPE kit and ventilators which have become. Malls hotels restaurants airports rail or road terminals parking garages petrol and service stations theatres and other similar buildings. Sugar Tea Coffee and Edible oil will fall under the 5 slab while cereals milk will be part of the exempt list under GST.

Using GST SAC code the. Cess on Petrol Motor Vehicles Capacity of 10-13 passengers 15. It was developed by the World Customs Organization.

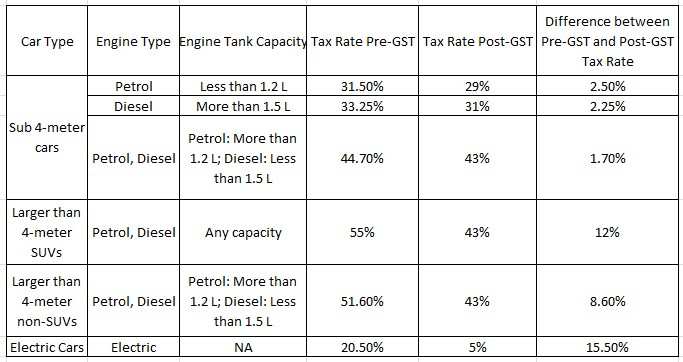

PLEASE REFER TO ADVISORY 122022 DATED 180522 ON SELECTION OF. This rule came into effect on 1 April 2021. A lower 12 cess on 1200 cc petrol and 1500 cc diesel vehicles.

Tax2win is amongst the top 25 emerging. ClearTax GST Software simplifies GST Return Filing GST Invoices and provides Free Hands on GST Training to Tax Experts Businesses. While some products can be purchased without any GST there are others that come at 5 GST 12 GST 18 GST and 28 GST.

GST rates for goods and services have been changed a few time since the new tax regime was implemented in July 2017. GST collection in May at over Rs 140 lakh crore. 22071011 22071019 22071090 22072000.

Signup for a Free Trial. Check out the various GST slabs rates and list of all items at Wishfin. Cess on Petrol Motor Vehicles Capacity of 10-13 passengers 15 1 Cess on Diesel Motor Vehicles Capacity of 10-13 passengers.

Claim 100 tax. Services Accounting Code also called as SAC Code is a classification system for services developed by the Service Tax Department of India. Petrol Liquefied petroleum gases LPG or compressed natural gas CNG driven motor vehicles of engine capacity of 1200 cc or more and of length of 4000 mm or more.

Goods and Services Tax GST rates have been revised for several items. Other than ethyl alcohol supplied to Oil Marketing Companies for blending with motor spirit petrol inserted on 27072018 2207.

Service Vat Invoice Template Invoice Template Invoice Template Word Invoice Sample

Fuel Prices And Taxes European Environment Agency

Fuel To Gst Centre State Relations May Emerge As A Rallying Point For Oppn Business Standard News

Germany S Vehicle Tax System Small Steps Towards Future Proof Incentives For Low Emission Vehicles International Council On Clean Transportation

Fuel To Gst Centre State Relations May Emerge As A Rallying Point For Oppn Business Standard News

What If Petrol And Diesel Come Under Gst India Sag Infotech

Gstr Due Dates List March 2019 Accounting Basics Important Dates Due Date

Sales With Vat Based On Quantity For Petrol And Diesel Haryana And Uttarakhand Vat

If Petrol And Diesel Are Brought Under Gst They Ll Have To Be Taxed At More Than 100 Mint

Gst On Petrol In 2022 Check Tax Rates Hsn Codes Here

Kia Stonic Ex Vs Kia Stonic Ex A Comparison Kia Tire Pressure Monitoring System Crossover Suv

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Expert Anticipates Further Fuel Price Rise In Coming Months Fuel Prices Petrol Price Tribune

Wep Bp Pro Handheld Thermal Billing Printer Experience The Joy Of Mobile Billing Also Available Applications Petrol Pu Handheld Printer Jewellery Advertising

Auto Gst Rates What Are The Gst Rates On Automobiles In India Auto News Et Auto

Gst On Petrol In 2022 Check Tax Rates Hsn Codes Here